Streamline Your Financial Trip With Trusted and Efficient Loan Providers

In the realm of individual financing, navigating the myriad of finance choices can commonly seem like an overwhelming job. When outfitted with the right devices and assistance, the trip towards protecting a lending can be streamlined and hassle-free. Relied on and effective lending solutions play a critical role in this procedure, offering people a trustworthy path towards their monetary goals. By comprehending the advantages of dealing with reliable lending institutions, checking out the various types of car loan solutions offered, and focusing in on vital elements that establish the ideal fit for your demands, the path to monetary empowerment becomes more clear. The real significance lies in exactly how these solutions can be leveraged to not just protected funds however also to maximize your financial trajectory.

Benefits of Relied On Lenders

When seeking economic support, the advantages of choosing relied on lenders are extremely important for a safe and dependable loaning experience. Trusted lending institutions provide openness in their terms, giving customers with a clear understanding of their commitments. By dealing with reputable loan providers, consumers can prevent surprise fees or predacious practices that might bring about financial risks.

In addition, trusted loan providers usually have established connections with governing bodies, making certain that they operate within legal boundaries and comply with market criteria. This compliance not just safeguards the customer however also fosters a sense of count on and reputation in the lending process.

Additionally, trusted loan providers focus on customer care, supplying assistance and guidance throughout the borrowing trip. Whether it's clarifying lending terms or assisting with payment options, trusted lenders are committed to helping borrowers make well-informed financial decisions.

Kinds of Finance Provider Available

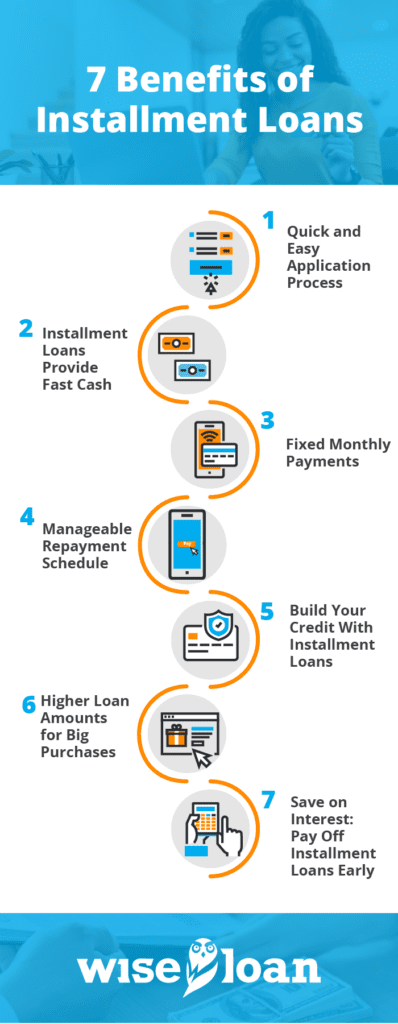

Different monetary institutions and financing agencies provide a diverse array of financing services to provide to the varying requirements of debtors. Some of the common kinds of loan solutions available consist of personal fundings, which are find more information typically unprotected and can be used for various purposes such as financial debt combination, home renovations, or unanticipated expenditures. Recognizing the different types of car loan services can help customers make educated choices based on their specific monetary requirements and objectives.

Factors for Selecting the Right Funding

Having acquainted oneself with the varied variety of car loan services offered, borrowers should meticulously assess key aspects to select one of the most ideal finance for their details economic demands and objectives. One vital aspect to consider is the rate of interest, as it straight impacts the total quantity paid back over the financing term. Consumers need to contrast passion prices from different lending institutions to protect the most affordable choice. Car loan terms also play an essential role in decision-making. Understanding the payment timetable, costs, and charges connected with the car loan is vital to avoid any kind of shocks in the future.

Additionally, borrowers should examine their present monetary circumstance and future prospects to identify the financing amount they can comfortably pay for. By carefully taking into consideration these variables, debtors can pick the right finance that aligns with their financial goals and abilities.

Streamlining the Financing Application Refine

Performance in the loan application process is critical for making certain a smooth and expedited loaning experience - merchant cash advance direct lenders. To streamline the car loan application process, it is vital to offer clear guidance to applicants on the needed documents and info. By including these streamlined processes, loan providers can use an extra reliable and user-friendly experience to consumers, inevitably boosting overall customer complete satisfaction and commitment.

Tips for Successful Lending Settlement

Prioritize your car loan payments to prevent skipping on any kind of loans, as this can adversely impact your credit score and monetary stability. In case of monetary difficulties, communicate with your loan provider to discover possible options such as finance restructuring or deferment. By remaining arranged, positive, and financially disciplined, you can successfully browse the procedure of repaying your car loans and attain better economic freedom.

Final Thought

To conclude, making use of relied on and effective loan services can greatly simplify your financial trip. By carefully choosing the ideal loan provider and sort of finance, and streamlining the application process, you can make certain an effective loaning experience. Remember to prioritize timely repayment to keep financial stability and construct a positive credit report. Trustworthy lenders supply important support to help you attain your economic goals - Financial Assistant.

Comments on “Attain Your Dreams with the Assistance of Loan Service Professionals”